Prepare and File an S Corporation Tax Election with Form 2553

Treated as an S Corp for Tax Purposes

If you want to reduce the amount of tax you pay on your LLC earnings, an S Corporation Tax Election (form 2553) is a necessity. This tax election tells the Internal Revenue Service to tax your LLC business as an S Corporation, which could reduce the amount of income on which you need to pay self-employment tax (including Social Security, Medicare and FICA). This can substantially reduce your tax bill with only a slight increase in administrative overhead for you and your accountant.

How LLCs Are Normally Taxed

2. You deduct any allowable business expenses

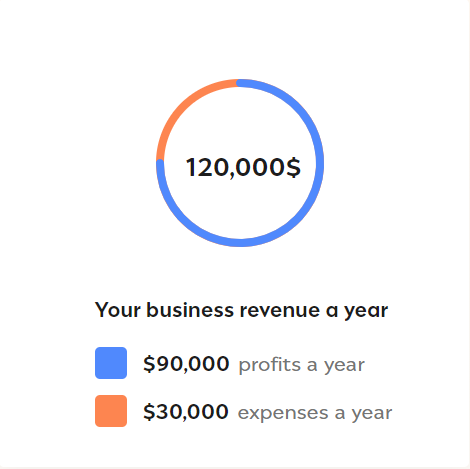

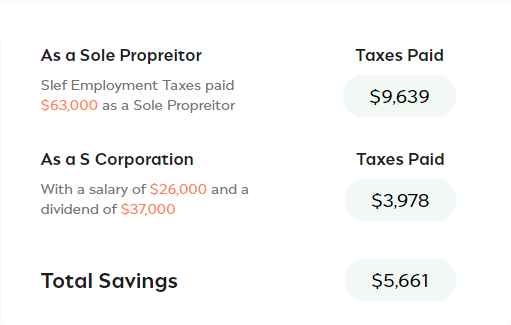

An Example of How an LLC Filing as an S Corporation Can Save Money

Let’s illustrate this with an example.

Self-Employment Tax as an LLC

Under a standard LLC tax arrangement where the income “flows through” to your 1040 tax return and business schedule C, you would pay self-employment tax on all of that $90,000. At approximately 15 percent, the tax on that money would be $13,500. You would still pay standard federal and state taxes on any earnings.

Payroll Tax as an S Corporation

Check the Savings Yourself with our S Corporation Tax Calculator

Assigning a Fair Salary

Administrative Overhead Of the S Corporation Election

Setting up monthly payroll

You will need to set up a monthly payroll where you pay yourself and submit your payroll taxes

Additional accounting fees

Your accountant will need to file your taxes in a slightly different way, which may increase your accounting fees

How to File Your S Corp Tax Election

File Form 2553, S Corporation Tax Election Yourself

If you want to complete the filing process yourself,

here are the steps you need to follow:

Help File My LLC S Corporation Tax Election

Save your time, we’ll handle the paperwork

We provide a complete S Corporation Tax Election service to register and file your LLC tax status with the IRS on your behalf. Just place an order and we’ll collect the right information to guide you through the process, and the IRS will notify you of your updated tax status.

Common Questions About Filing Your S Corporation Tax Election

Does filing form 2553 remove any LLC protections?

How much could I save by being treated as an S Corporation for tax purposes?

Do I have to file my S Corporation Tax Election at a certain time?

Yes. There are certain limitations on when you can file form 2553. This article gives you all the details you need.

Can I file an S Corporation Tax Election if there are more owners in the business?

Yes. S Corporation Tax Elections are available to most LLCs. For more information, speak to your accountant or attorney.